Trading strategies for family offices to participate in global Forex, financial futures, and commodity markets

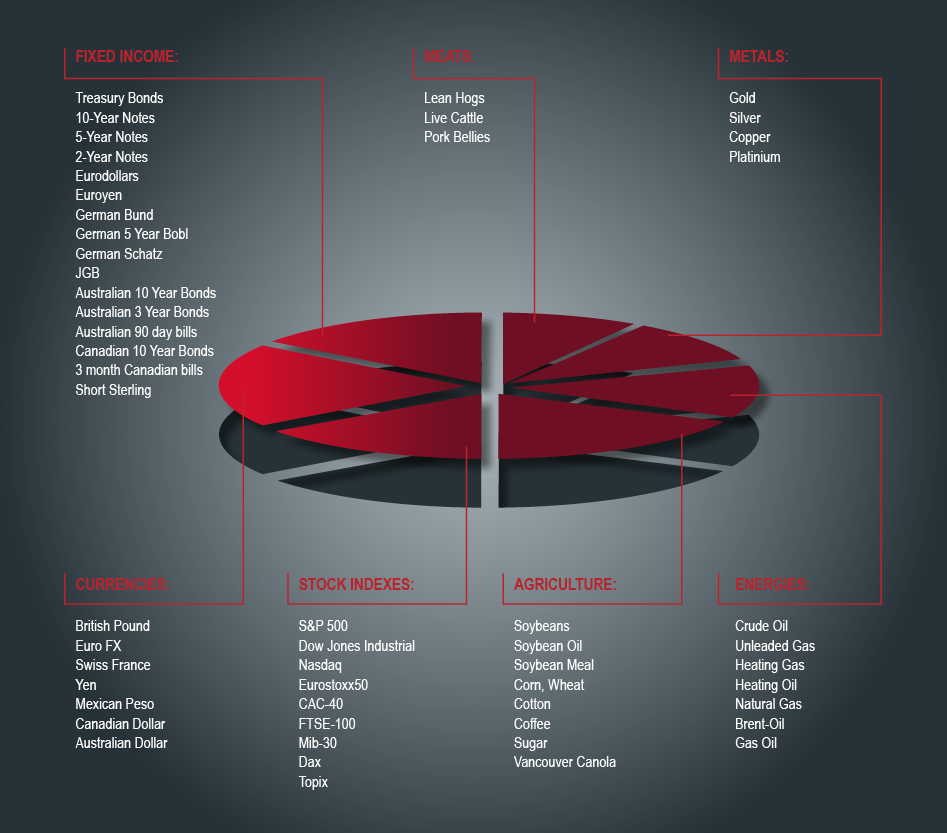

Futures trading systems use global markets in foreign exchange, financial futures, and commodities to generate returns that are not correlated to those of equity and fixed-income investments. These trading strategies can be applied to various futures markets worldwide, including interest rate, equity, currency, grain, soft, metal, and energy contracts in Europe, the U.S., Canada, Japan, and Australia. They consist of trend following, counter-trend, and chart pattern strategies, and can use various proprietary trading models that act independently of each other. Each model generates its own entry and exit signals and can trade either long or short. In volatile economic environments, which can cause stress to a typical stock and bond portfolio, a managed futures investment program can be an optimal choice.