Trading strategies for family offices to participate in global Forex, financial futures, and commodity markets

GLOBAL DIVERSIFICATION

Dr. Harry Markowitz

William Sharpe

Diversification is based on the idea that a trader’s ability to predict market outcomes is uncertain. Therefore, investing in various asset classes simultaneously is considered less risky than investing solely in a single commodity. This approach is founded on the belief that a prudent investor seeks to maximize returns for a given level of risk, rather than simply aiming to maximize returns. Modern Portfolio Theory, developed by Nobel laureates Dr. Harry Markowitz and Professor William Sharpe, is based on this principle.

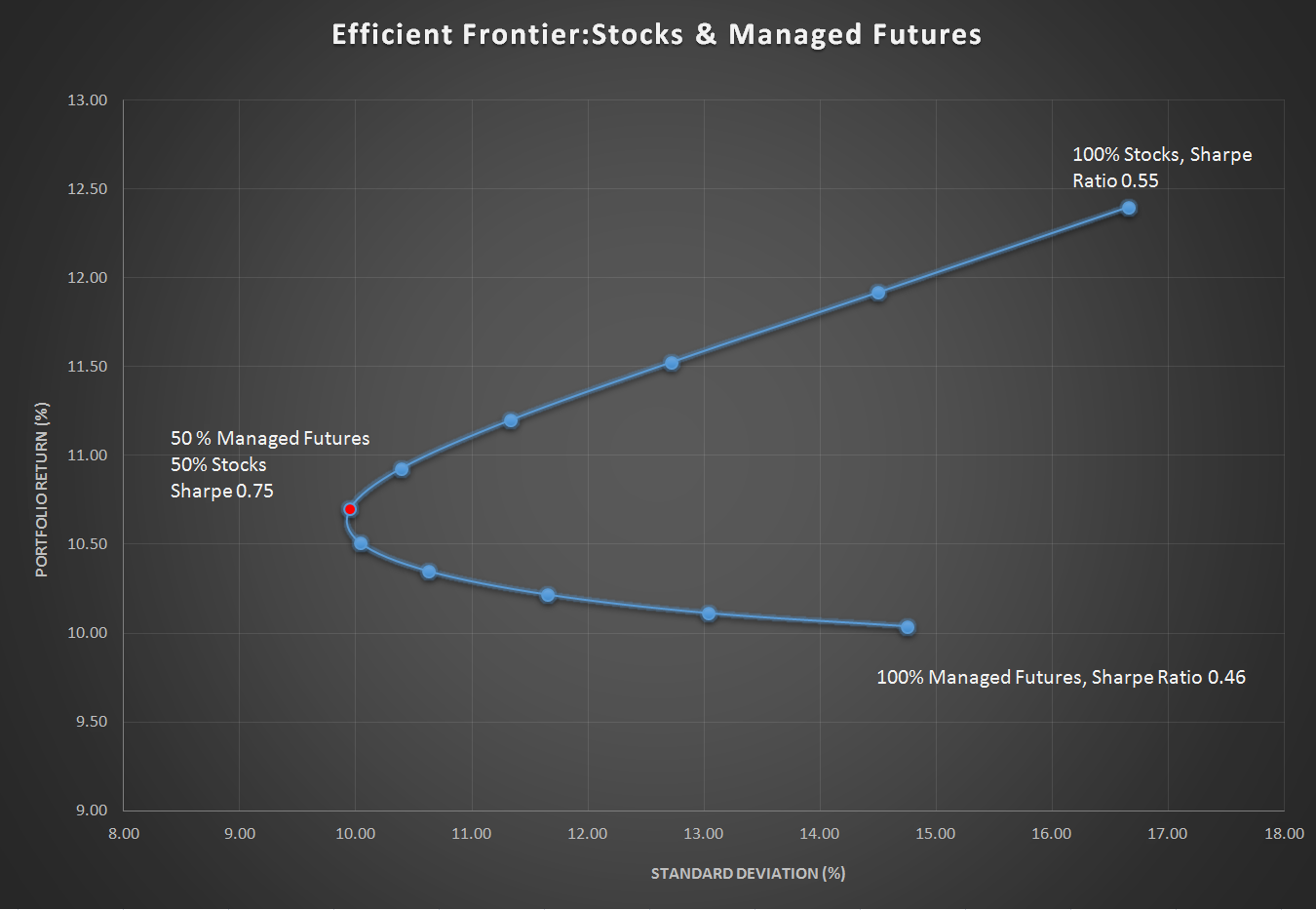

The Sharpe Ratio is a common tool for assessing risk-adjusted returns. It quantifies the excess return that an investor receives in relation to the volatility of a riskier asset. A higher Sharpe Ratio indicates a higher return for a given level of risk. This ratio measures the average investment return after subtracting the risk-free rate of return, and then dividing the result by the standard deviation of investment returns. Our calculations will assume an average risk-free rate of 3.26% since 1985.

Managed futures (CTAs) have a history of exhibiting low correlation with equities, and their addition to a stock portfolio has historically yielded several benefits. This includes improved risk-adjusted returns, reduced correlation to equities, a more favorable drawdown profile, and crisis alpha. For example, since 1985, adding managed futures to a stock portfolio in a ratio of 1:1 has increased the Sharpe ratio from 0.55 to 0.75.

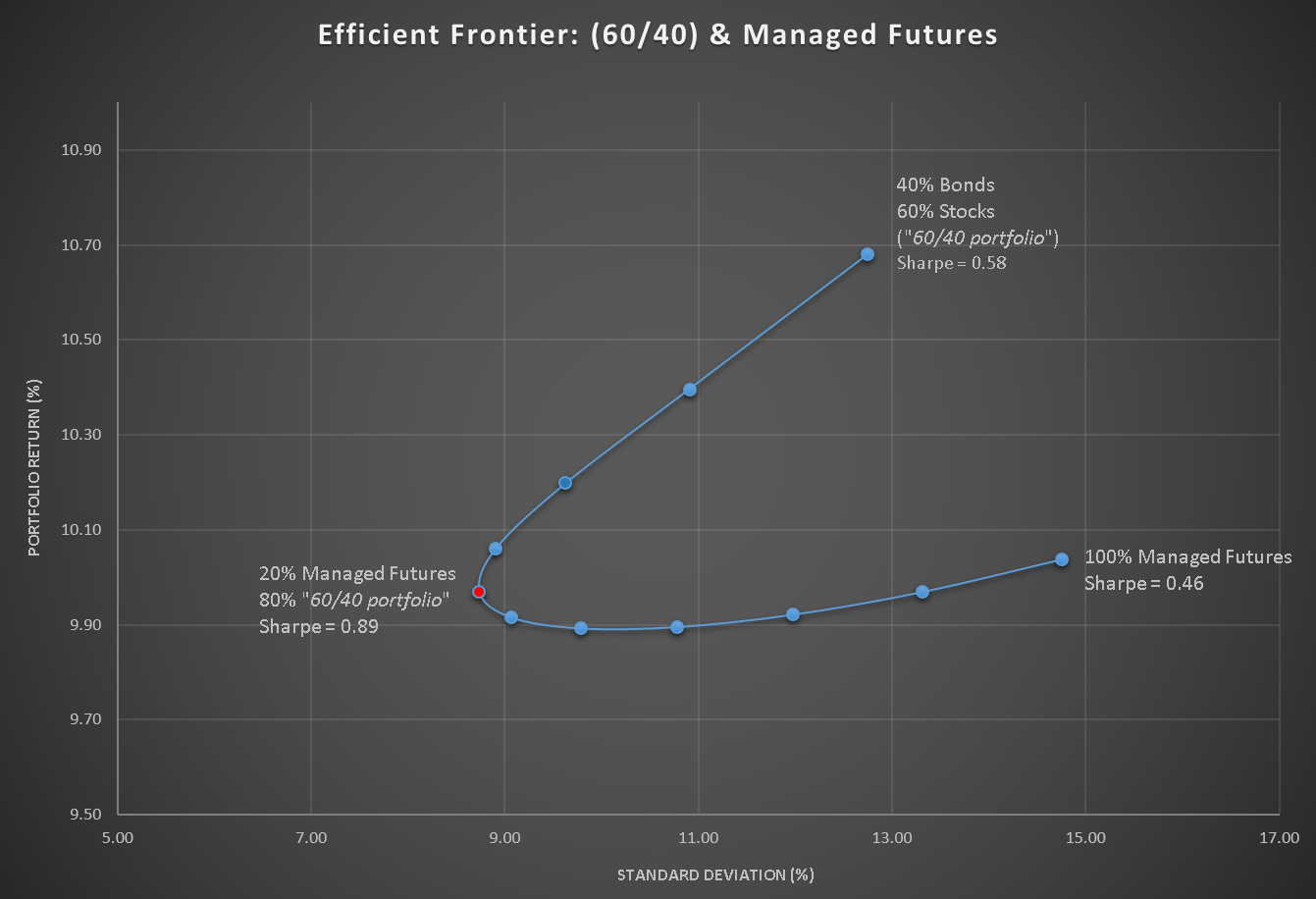

A popular investment strategy for decades has been the “60/40 portfolio,” which is a straightforward combination of 60% large-cap stocks and 40% investment-grade bonds. When managed futures are added to this 60% stock/40% bond portfolio, the Sharpe ratio has historically improved from 0.58 to 0.89.

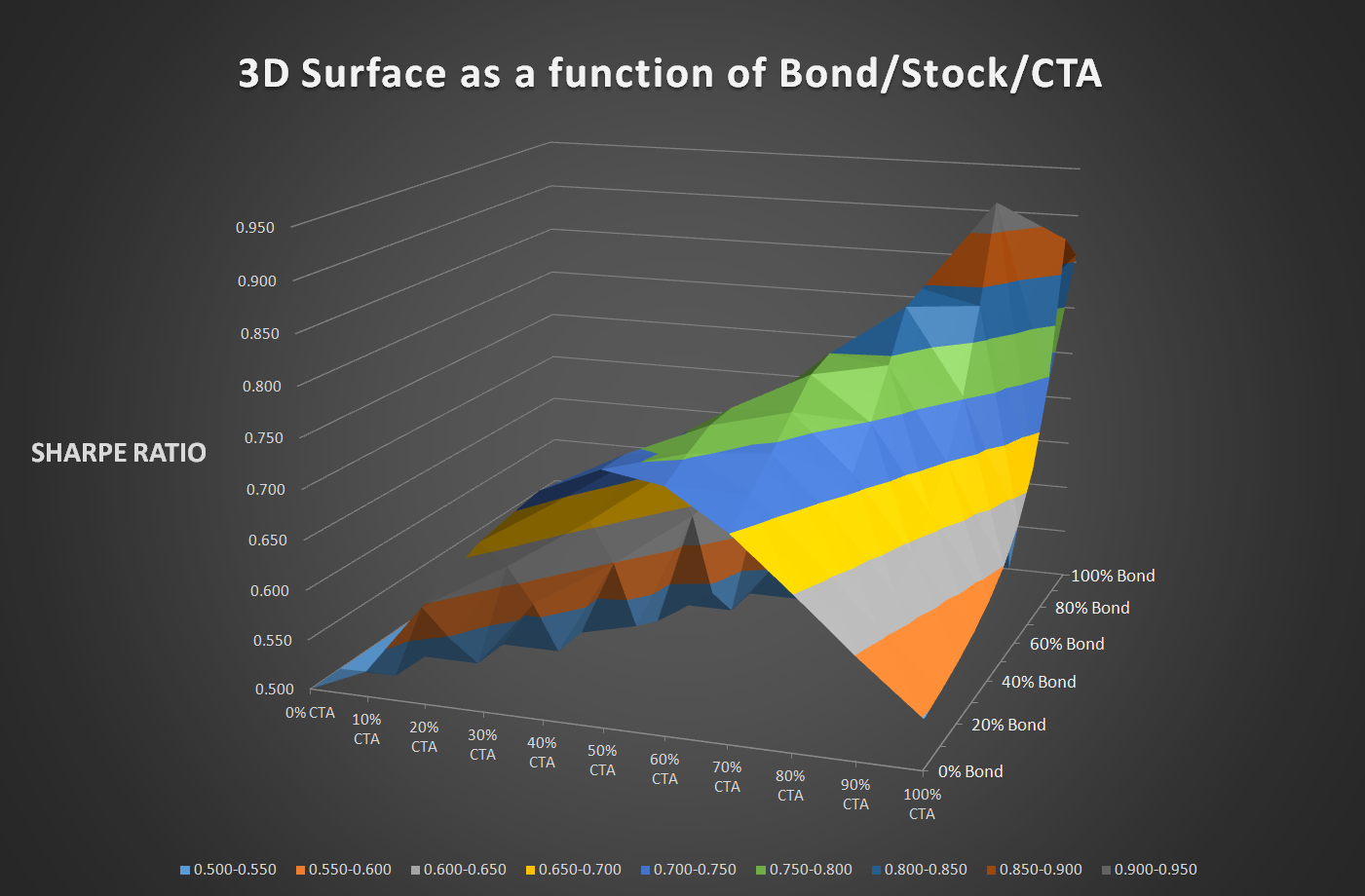

An optimal mix of stocks, bonds, and managed futures is determined to be 10% stocks, 80% bonds, and 10% managed futures. Although the expected return is lower, decreasing from 10.68% to 7.66%, the risk has also significantly decreased from 12.75% to 4.73%. This results in an improved Sharpe ratio from 0.73 to 0.93 when compared to a 60/40 portfolio.

GLOBAL DIVERSIFICATION

Investment portfolios can benefit from diversification across various markets, including but not limited to:

The inclusion of both short and long positions in these markets can provide extensive diversification opportunities.