Trading strategies for family offices to participate in global Forex, financial futures, and commodity markets

Member Login

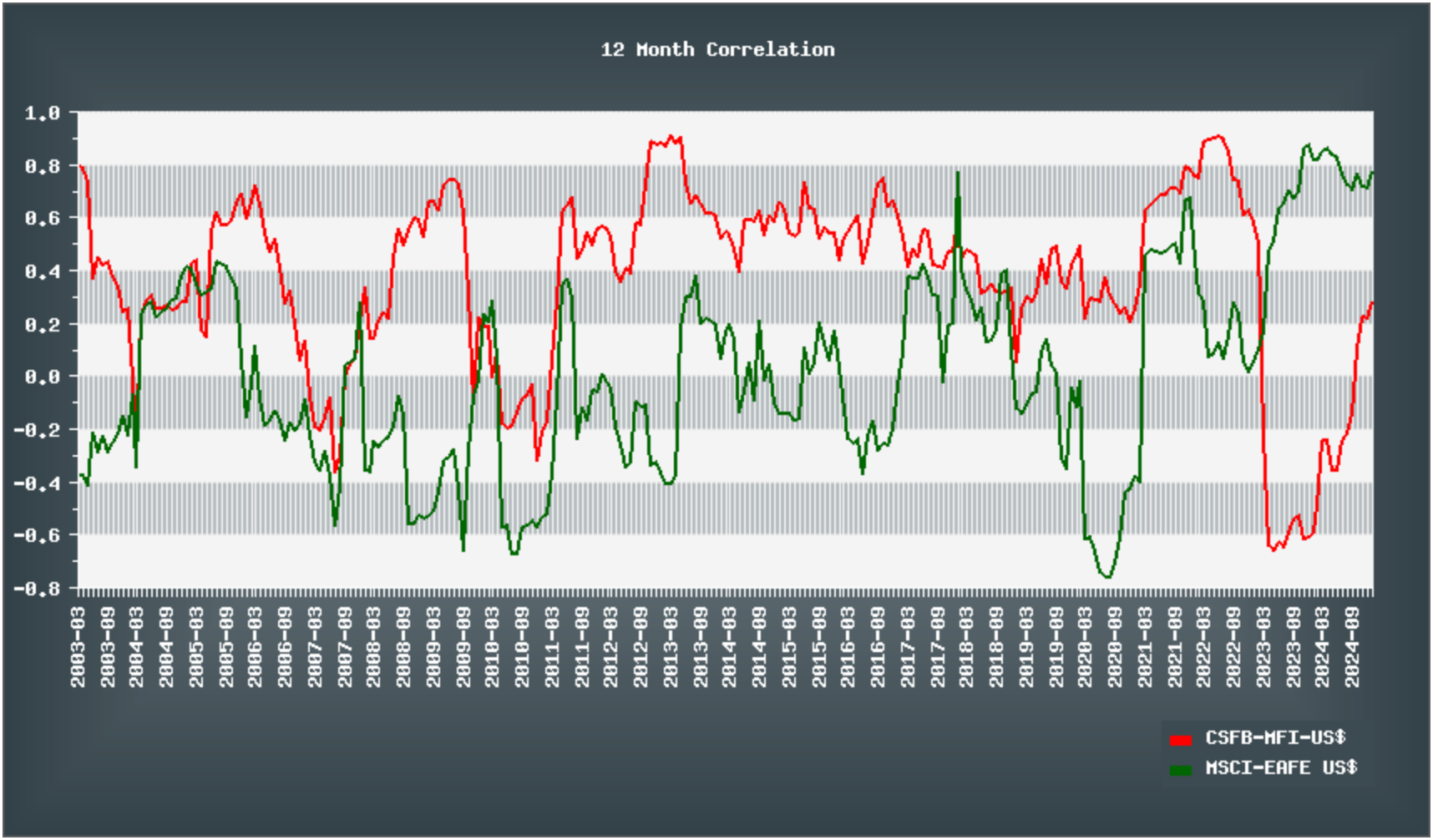

CORRELATION

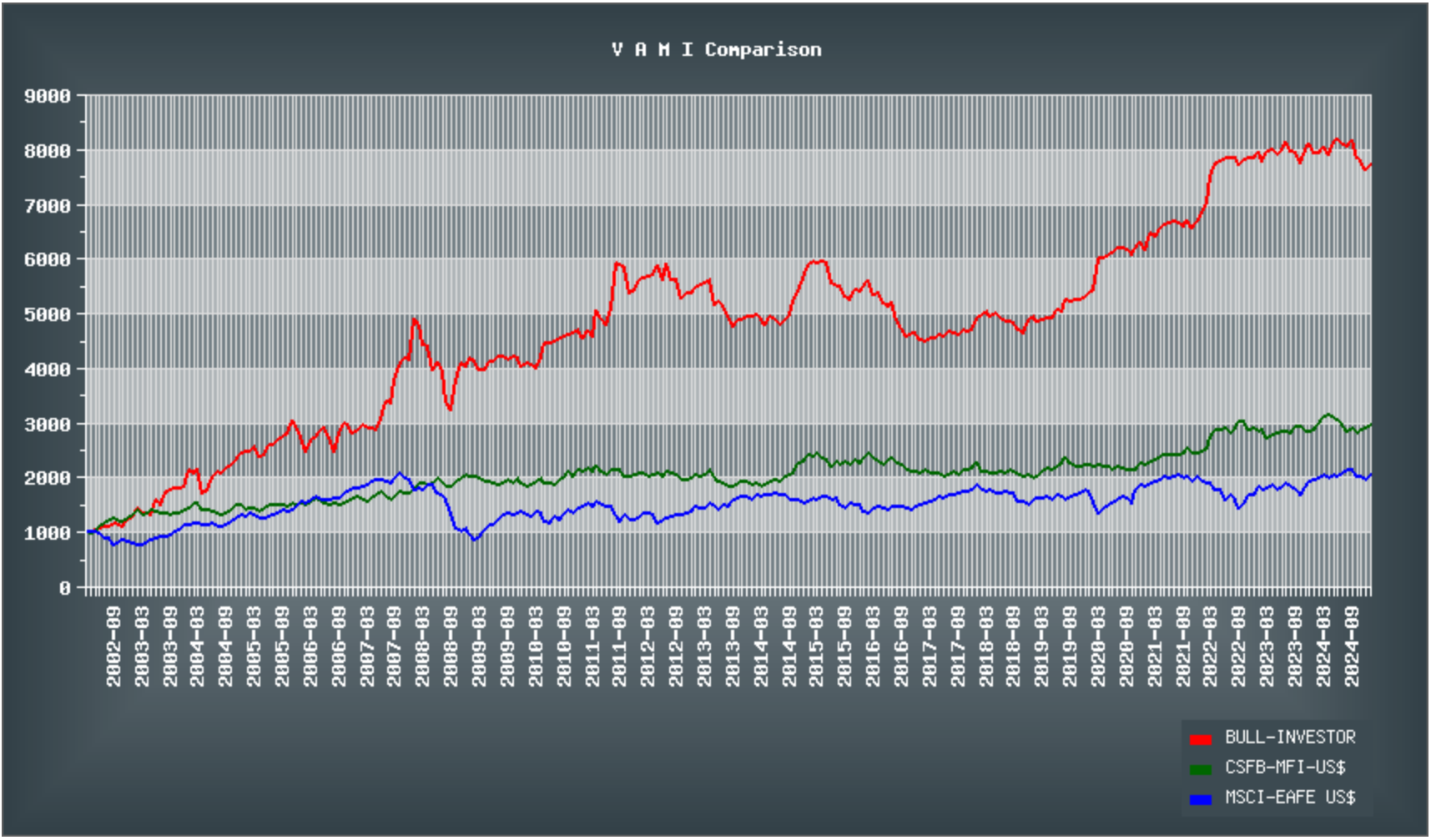

The VAMI, or Value Added Monthly Index, tracks the growth of a hypothetical $1000 investment over time. The index begins at 1000 US dollars and subsequent monthly values are determined by multiplying the prior month’s VAMI by 1 plus the current month’s rate of return. In the chart provided, we compare the VAMI of a family’s portfolio of systems with the CSFB Managed Futures Index (US $) and the MSCI-EAFE Stock Market Index.

The correlation between the benchmark indices mentioned above and the family’s traded Portfolio of Systems is illustrated in the chart below.